The Future of ATM Driving

New services and experiences on ATM’s.

Banks today are demanding more from their ATM, including:

- More stand-alone ATMs with additional self-service capabilities required for existing branches

- Low and no-touch banking experiences at the ATM

- Integration to digital wallets at the ATM to provide ‘cash out’

- Address the needs of SME’s through ATM’s

- Explore ways in which APIs can help build a broader self-service ecosystem

- Value Added Services including Dynamic Currency Creation

Why BankWorld ATM?

- Single solution that incorporates ATM Client, Switch and Card Management System

- Real-time ATM and Fleet Management tools that manage both simple and complex ATM networks and reduces the overall cost of ownership

- Full stack vertical solution, incorporating all required elements from software client to the scheme gateways

- Engaging user interface delivering an enhanced customer experience

- 30+ off-the-shelf services including cardless, bill payment, funds transfer, campaigns and promotions

- ATM Design Studio gives independence and control to design and launch personalised offers

- Retain control of screen flows and transaction mix

- Enable digital transactions in a self-service environment

- Rich card control functionality merging mobile and ATM channels

- Strongest integration capabilities proven in market with multi back-office integrations completed

- Experience with a wide range of global and local payment schemes such as Visa, Mastercard, UPI and a wide range of local and national switches

- Including biometric scanners, cash recyclers, NFC card readers, statement printers. Hardware vendors support includes NCR, Wincor, Diebold, Hyosung and GRG.

Do more with ATM’s

We can assist with the migration of more advanced transactions from the teller to self-service terminals and offer a rich set of capabilities such as:

- Contactless access ATM over NFC, QR Code access and use of E-receipts

- Account opening and onboarding

- Cash lodgement

- Bill payment

- Card Issuing

- Foreign exchange

- Cheque scan deposit

- Digital wallet load and unload

- Remittances/payments

- Loan origination/Instant loan

- Card self-service features such as change/set PIN, and activation

- Registration for mobile banking

- Social security disbursement

- New product application

- Remote Key Loading (RKL)

- Remote web administration

- More effective cash management with a dashboard view of ATM cash levels

ATM Software Solution that delivers…

BankWorld ATM is the most advanced end-to-end self-service banking software solution which accelerates branch transformation strategies. It means a bank can drive more fees from an unrivalled suite of ATM and kiosk services and more revenues from targeted campaigns, all underpinned by a platform delivering increased uptime and reduced operational cost.

Built to increase the channel’s profitability, BankWorld ATM is the only end-to-end ATM software solution available that incorporates a versatile switch, a rich dynamic client and a powerful card management system with real-time operational and business tools.

Mobile-like functionality at the ATM, offers an enriched user experience that is:

- faster

- simple to use

- significantly reduces the cost to serve customers by moving in branch services to a self-service channel.

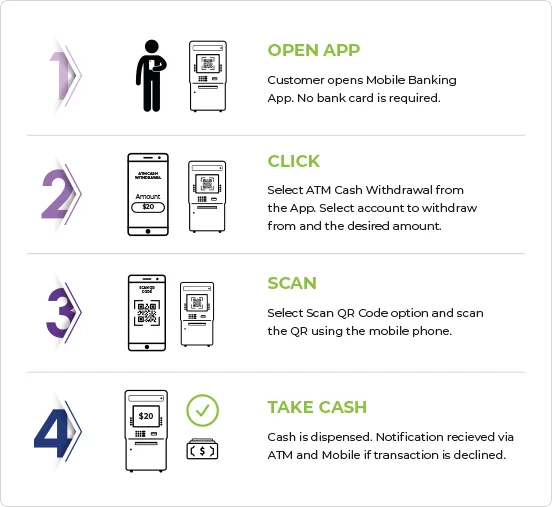

Cardless Access

CR2’s BankWorld ATM client intersects the physical channel with the bank’s own mobile banking app to provide a cardless, safe access to cash. The solution is available on all BankWorld ATM Clients, and seamlessly integrates with the existing card management system and mobile app deployed within the bank.

The cardless solution allows customers to leave their cards in their wallets and withdraw cash using their mobile phones, by simply scanning a QR Code on the ATM using their mobile phone. It’s safe, quick and convenient.

ATM Driving that delivers more revenue

BankWorld ATM offers a complete software solution that harnesses the power of ATM driving, providing users with access to the banks entire business functionality from the ATM. It includes the driving of innovative services and transactions at the client level, effective management and monitoring of the entire ATM fleet from a central point, the ability to quickly and remotely launch new marketing campaigns, screenflows, language etc., all underpinned by a platform that delivers security and scalability.

A powerful set of management and operational tools:

- ATM Manager

- ATM Distributor

- ATM Support Tool

- ATM Studio

- ATM Custodian

- ATM E-journal Viewer

ATM and POS Acquiring

The BankWorld platform offers banks a complete solution for ATM and POS acquiring with capabilities that accept cards associated with all major global and local international schemes, ‘on-us’ and ‘not on-us’ acquired ATM and POS transactions.

The solution identifies the card scheme that it’s related to and routes and logs transactions through the switch hub accordingly. BankWorld POS offers areas of expertise at retail level, teller level and processing of MasterCard MIGs settlement for e-commerce.

- Multiple Currency – acquire transactions in any currency

- Extended Card Schemes – international card schemes supported

- Merchant Settlement – easy settlement with the merchants and produce settlement files and reports

- Minimise Interchange Fees – the system automatically requests the cheapest interchange rate available

- Reporting – a suite of reports available

- Easy to Administer with simple GUIs for effective management of the system

- Fee Calculation

- Target competitor bank’s card holders with attractive campaigns based on the card bin of the particular bank

Self-service Kiosk Solutions

BankWorld Kiosk is a powerful and integrated channel which can be easily deployed and used to provide innovative services to customers and non-customers. It is an intelligent hybrid system which has built-in support for devices as well as providing card authentication and statement printing.

Your customers can avail of personalised payments, card control functionality, instant account opening, Money Vouchers, P2P payments and domestic and international remittances, all from this versatile and convenient channel. Non-customers can also access a range of banking services including bill payments, domestic remittances, money vouchers and more.

BankWorld Kiosk seamlessly integrates with your other self-service channels enabling you to give your customers a consistent user experience at every touch point.

Book your free

consultation now!

We look forward to sharing our insights and case studies with you.