Digital Wallet

Grow your digital customer base

CR2’s Digital Wallet solution enables consumers to easily and instantly make purchases or send and receive money through their smartphone.

For banks, digital wallet offers strategic competitive advantages:

- Accelerate growth of digital customer base

- Excellent recruitment to reach new customer segments

- Compete within the digital wallet market

- Solve for financial inclusion

- Execute a digital payment strategy

Powering three propositions

Wallet Banking

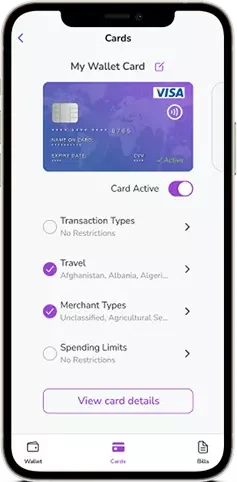

Cards for Wallet

Agency Wallet

Benefits of Digital Wallet

Digital Wallet features

- Merchant payments (NFC and QR) and e-commerce

- P2P

- bill payments

- pull payments

- The services are available in multiple languages so that customers can operate in their language of choice.

- A portal for bank staff to complete KYC (Know Your Customer) registrations at branches allow for quick and seamless onboarding.

- System limits allow the bank to define how much can be held in a wallet account. Once these limits are exceeded the excess is moved into an overflow account.

- Overflow accounts for non-bank customers are also BankWorld accounts shared in a single pooled back office account.

- Existing bank customers can nominate another account as their overflow account

Wallet Funding

- Another bank account

- Visa, Mastercard or Amex card

- Agent

- At the ATM

- Through the wallet

- Cash-in at branch

- Remittances

- Bulk loading

Payments

- Request a bill/ subscription

- Add a new bill

- Pay through QR Code

- Pay a merchant through NFC

- Buy a ticket

- Pay through a payment link

- Pay 3rd party fee

- Request money from another user

- Send money to another user

Book your free

consultation now!

We look forward to sharing our insights and case studies with you.