Agency Banking

Nearly 1.4 billion people worldwide have no access to bank accounts, despite the growing global account ownership.

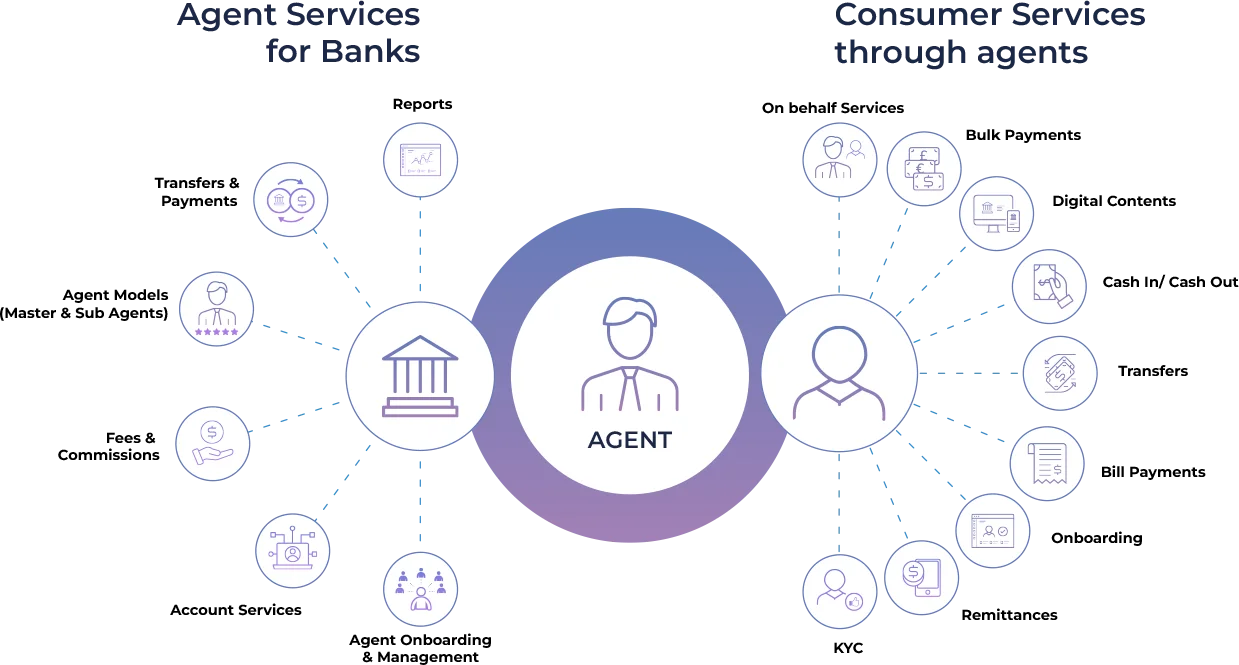

Agency Banking is an effective channel to reach consumers through a low cost network of affiliated merchants and business entities.

CR2’s digital banking platform manages and controls these agents. Through bank driven monitoring and process guidelines, agents can provide key digital payment services which are essential for enabling financial inclusion. This is achieved through a cost effective managed account, which is serviced through multiple customer touch points.

Agency networks are supported by many services including:

- comprehensive remittance services,

- account origination services,

- bill payment services,

- KYC

Benefits to Banks

Decongest Banks: Allows bank staff to focus on more complex transactions, providing a better customer experience

Revenue Growth: Tap into untapped markets, increase customer base and offer new services to local agents

Cost reduction: reduce the cost of infrastructure, staffing and ATM network to offer services to customers without the need for a physical branch.

Digital Transformation: Banks can incorporate the cash economy into digital transactions, providing customers with convenient financial services while increasing agility

Book your free

consultation now!

We look forward to sharing our insights and case studies with you.